Annual Recurring Revenue (ARR) is a vital metric for businesses, representing the predictable and recurring revenue generated from subscriptions, contracts, or services annually. Understanding and optimizing ARR is crucial for sustaining growth and financial stability.

Understanding Annual Recurring Revenue (ARR)

ARR encompasses the total revenue expected from subscriptions or contracts over a year. It’s a cornerstone metric for subscription-based businesses, indicating the revenue that can be counted on annually.

What constitutes ARR?

ARR comprises all recurring revenue streams, including monthly subscriptions, annual contracts, and any other predictable income generated from ongoing services or products.

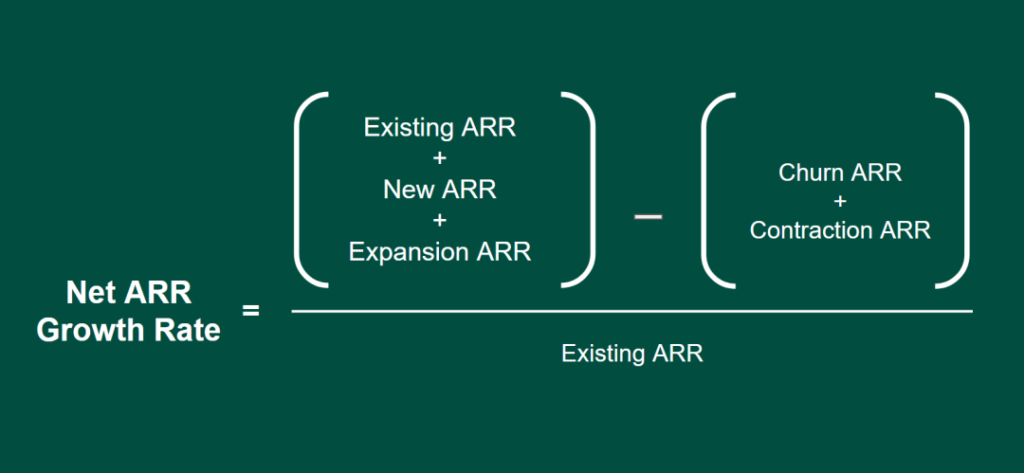

Calculating ARR

ARR can be calculated by multiplying the average revenue per user (ARPU) by the total number of customers and the average subscription duration.

Growth strategies for ARR

Businesses can drive sustained growth in ARR through strategies such as expanding customer base, increasing average revenue per user, and reducing churn rates.

Benefits of ARR

ARR offers several benefits for businesses aiming for sustained growth and stability.

Predictable revenue stream

ARR provides a reliable and predictable revenue stream, enabling businesses to forecast future earnings accurately.

Financial stability

By establishing a base of recurring revenue, ARR contributes to financial stability, reducing dependency on one-time sales and ensuring consistent cash flow.

Scalability

Businesses with high ARR have a solid foundation for scalability, as recurring revenue allows for better planning and investment in growth initiatives.

Key Metrics for ARR

Monitoring key metrics associated with ARR is essential for optimizing revenue generation strategies.

Customer acquisition cost (CAC) and lifetime value (LTV)

Understanding the relationship between CAC and LTV helps businesses determine the profitability of acquiring new customers and maximizing their lifetime value.

Churn rate

Churn rate, the percentage of customers who cancel their subscriptions, directly impacts ARR. Lower churn rates contribute to higher ARR and sustained growth.

Expansion revenue

Identifying opportunities for upselling or cross-selling to existing customers increases expansion revenue and boosts ARR over time.

ARR Optimization Strategies

Optimizing ARR involves implementing strategies to enhance customer retention, maximize revenue per user, and continually improve product value.

Improving customer retention

Prioritizing customer satisfaction and delivering exceptional experiences can reduce churn rates and increase customer lifetime value, ultimately boosting ARR.

Upselling and cross-selling strategies

Identifying upselling and cross-selling opportunities allows businesses to capitalize on existing customer relationships and increase revenue without acquiring new customers.

Enhancing product value

Continually improving product features, functionality, and usability increases perceived value for customers, leading to higher satisfaction and increased willingness to pay.

FAQs

- What is the significance of ARR?

ARR signifies the predictable and recurring revenue generated from subscriptions or contracts annually, providing businesses with financial stability and growth opportunities. - How does ARR differ from MRR?

ARR represents the total annual recurring revenue, while Monthly Recurring Revenue (MRR) reflects the monthly recurring revenue generated from subscriptions or contracts. - What are common challenges in ARR calculation?

Common challenges include accurately tracking revenue from various sources, dealing with fluctuations in subscription durations, and accounting for discounts or promotions. - How can businesses increase their ARR?

Businesses can increase ARR by acquiring more customers, increasing average revenue per user, reducing churn rates, and expanding product offerings or services. - What role does customer success play in ARR growth?

Customer success initiatives aim to maximize the value customers derive from products or services, leading to higher satisfaction, retention, and ultimately, increased ARR. - How does ARR affect investor confidence?

High ARR indicates a strong foundation of recurring revenue, which enhances investor confidence in the company’s financial stability and growth potential.

Conclusion

Understanding and optimizing Annual Recurring Revenue (ARR) is essential for businesses seeking sustained growth and financial stability. By focusing on enhancing customer relationships, maximizing revenue opportunities, and continually improving product value, businesses can drive significant increases in ARR over time.